[fusion_dropcap color="#000000" class="fusion-content-tb-dropcap"]R[/fusion_dropcap]esidual Income vs. Passive Income—which is the right choice for you? Both income sources as attractive roads to financial freedom but are designed for different work styles and aspirations. Residual income is repetitive income resulting from activities such as book royalties or business commissions, whereas passive income is straightforward earnings backed by investments such as rental properties or dividends. The solution isn’t about choosing one but balancing both. Creating residual income can yield active returns, and then reinvesting the idle income creates long-term stability.

This article delves into the differences between Residual Income vs. Passive, income generating, insights, examples, and strategies to assist you in making the choice. You’ll learn about which of these income sources are available, their advantages and disadvantages, and how integration of these can lead to a diversified and stable financial destiny.

What is Passive Income?

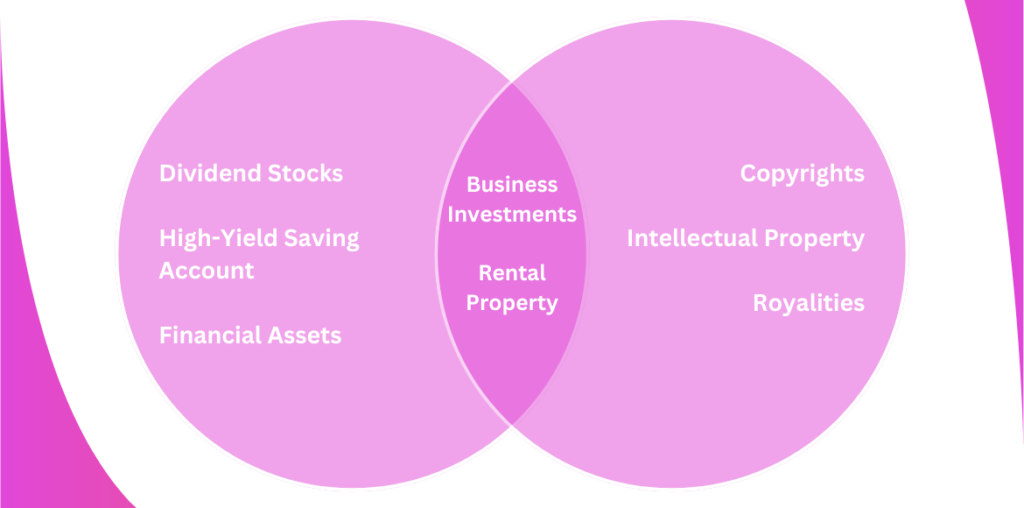

Passive income is defined as income that demands little to no further effort after the initial setup. It is often seen as the pinnacle of financial independence, allowing individuals to earn money without actively working for it. Typical cases are rental income from real estate, dividends from financial equity, royalties from arts and creative works including books or music, and income from digital products or affiliate marketing.

Nurturing passive income is appealing due to the promised ability to achieve financial stability and freedom. After a system or asset has been installed, it may keep generating revenue with very low upkeep. For example, a properly maintained real estate investment may generate stable rental income for many years, whereas stock dividends offer continuous payments only if the company is profitable. However, passive income often demands substantial initial investment, either in terms of capital or effort. It may take months or even years to build a reliable stream of passive income, and external factors such as market fluctuations can impact its stability.

Examples of Passive Income

- Rental Income: Earnings from renting out property, such as apartments, houses, or commercial spaces.

- Dividends: Payments received from owning shares in dividend-paying companies.

- Royalties: Income earned from creative works like books, music, or patents.

- Online Courses: Sales proceeds of educational material on websites such as Udemy or Teachable.

- Peer-to-Peer Lending: Interest earned from lending money through platforms like LendingClub.

Pros and Cons of Passive Income

Pros

- Once established, passive income requires little to no active management, freeing up your time for other activities or investments.

- Passive income streams, like rental properties or digital product sales, can be expanded without proportionally increasing your workload. For instance, you can add more properties to your portfolio or create additional digital content.

- Successful passive income streams can generate wealth for years or even decades, providing a steady revenue stream even during retirement.

- With minimal ongoing involvement, passive income can allow you to live or work anywhere, granting you more control over your time.

Cons

- Many passive income ventures require significant upfront financial or time investment, such as purchasing real estate, creating a course, or building an app.

- Establishing a passive income stream that generates meaningful returns can take months or even years.

- Passive income sources like real estate and investments are vulnerable to economic downturns, market fluctuations, or changes in demand.

- Although ongoing involvement is minimal, some passive income streams require occasional upkeep, such as managing tenants or updating digital products.

What is Residual Income?

On the other hand, residual income is simply profit that remains after the initial work is done, but it often needs regular effort to maintain. The kind of income is usually tied to activities, for example, commissions from sales, royalties from intellectual property, and revenues from subscription-based offerings. For example, a salesperson might continue earning residual commissions on a product they sold years ago, provided the customer renews the subscription or makes additional purchases.

Residual income is appealing because it offers a consistent and ongoing cash flow which can fill the gaps in other income sources. Professionals in business like insurance or network marketing, or in the arts, sometimes will use it. Although residual income may not require the same time immersion as permanent employment, it can typically depend on the continuing consultation with a client’s representatives or some care of the product/service somehow under a time window. The dependence on this kind of external factor (customer loyalty or market demand), for example, can lead to a certain degree of uncertainty.

Examples of Residual Income

- Post-Expense Earnings: If your monthly income is $5,000 and expenses are $4,000, the remaining $1,000 is your residual income.

- Loan Payments: Extra money left after paying off monthly debts, such as car loans or mortgages.

- Business Revenue: A company’s profits after covering all operating costs and debt repayments.

- Equity Investments: Gains after subtracting the cost of capital from net profits.

- Subscription Models: Earnings from businesses like SaaS platforms or memberships after covering fixed costs.

Pros and Cons of Residual Income

Pros

- Residual income streams often provide regular, recurring earnings, such as monthly commissions or subscription fees.

- Unlike passive income, many residual income opportunities require less capital upfront. For example, a salesperson may earn residual commissions with minimal start-up costs.

- Residual income can serve as a supplemental income source while you maintain a traditional job or business.

- Many residual income streams start yielding results sooner compared to passive income. For instance, network marketing or subscription services can generate earnings in a matter of weeks or months.

Cons

- Residual income often involves continuous involvement, such as maintaining client relationships, following up on sales, or providing customer support.

- Residual income streams can be disrupted if clients or customers stop purchasing or cancel subscriptions.

- Unlike passive income, residual income often depends on personal effort or client interaction, making it less scalable without hiring additional resources.

- Residual income, especially from sales commissions or subscriptions, is sensitive to shifts in consumer preferences or economic conditions.

Residual Income vs. Passive Income: Key Differences

| Aspect | Passive Income | Residual Income |

|---|---|---|

| Effort After Setup | Minimal | Moderate |

| Time to Establish | Often takes longer | Relatively faster |

| Predictability | Depends on market stability | More predictable, tied to client retention |

| Scalability | High, limited only by resources | Moderate, dependent on personal involvement |

| Upfront Investment | High (time, money, or both) | Low to moderate |

| Sustainability | Can last indefinitely if well-managed | Requires periodic engagement to sustain |

Factors to Consider When Choosing

When deciding between passive and residual income, consider your financial goals, available time, and resources. Passive income is best for those wanting to achieve long-term financial independence. It often requires a significant initial investment, either in terms of money or effort, but offers the potential for high scalability and minimal ongoing involvement. To take one example, an individual with capital available to invest in real estate or dividend-paying stocks might find passive income more attractive.

In opposed, residual income is attractive to those who look for predictable cash flow and are comfortable with minimal effort to keep it up over time. It may be particularly useful to people having a good interpersonal profile, or an antecedent in sales since these are frequently needed in order to keep close relationships with the customers or to acquire more customers.

Additionally, risk tolerance is an important factor. Passive income streams (real estate and stock investments) can be susceptible to market swings, and residual income is contingent on, among other things, consumer loyalty and market dynamics. Taking risks to your comfort level in these risks can inform decision-making.

Can You Combine Both?

It is good news that you do not have to only resign from passive income or residual income many people can take both routes. Particularly, a real estate investor could generate passive income from rental properties while at the same time generating some residual income from a property management company. Specifically, a digital content creator can earn passive income by participating in affiliate marketing and earn continuous income by providing subscription services, or members’ only access.

By combining these approaches, you can diversify your income streams, creating a balanced portfolio that offers both stability and growth potential. This approach not only reduces risk, it also exploits the inherent advantage of the two income types, so that the two income types work together to improve the outcome.

Finding the Right Balance

When comparing Residual Income vs. Passive Income, the decision is related to the level of engagement, the goals, and to skills, that are sought by the user. Residual income is motivated by the degree of efforts and innovation efforts, whereas passive income is motivated by the level of independence and derivative growth. By understanding each of its advantages and disadvantages, you can develop a balanced strategy based on your goals. Focusing on the one or combination of both, the act of acting is the cornerstone of creating a secure and fulfilling financial future.

Frequently Asked Questions (FAQs)

What is the main difference between residual income and passive income?

Residual income is the money left after paying all expenses or debts, while passive income is earnings generated with minimal ongoing effort, such as rental income or dividends.

Can residual income and passive income overlap?

Yes, they can overlap. For example, rental income can be considered passive income, and after deducting related expenses, the remaining amount could be residual income.

Which is better: residual income or passive income?

Both have their advantages. Passive income helps create a consistent revenue stream with little effort, while residual income measures your financial stability and ability to invest or save.

How can I start earning passive income?

You can earn passive income by investing in rental properties, dividend-paying stocks, peer-to-peer lending, creating online courses, or selling digital products.

How can I increase my residual income?

To increase residual income, focus on cutting expenses, paying off debts, increasing your active income through a side hustle, or reinvesting passive income into higher-yield opportunities.

Leave a Reply