[fusion_dropcap color="#000000" class="fusion-content-tb-dropcap"]P[/fusion_dropcap]assive income is a powerful financial strategy that allows individuals to earn money with minimal ongoing effort. Unlike active income, where consistent work is required, passive income can provide financial stability and freedom by generating revenue even when you’re not actively working. This income stream can come from various sources, such as rental properties, stock dividends, or royalties from intellectual property. Understanding the key elements of passive income, its history, and how it works can help individuals take steps toward financial independence and long-term wealth building.

In this article, we’ll explore what passive income means, trace its historical roots, and look at how it has evolved with modern trends, providing new opportunities for those seeking to generate income with less hands-on involvement.

What Does Passive Income Mean?

Passive income refers to earnings generated with minimal ongoing effort after an initial setup phase. Unlike active income, where you trade time for money, passive income is derived from assets or ventures that continue to generate revenue without your direct, day-to-day involvement.

According to the Internal Revenue Service (IRS), passive income includes trade or business activities in which you have limited material participation, such as rental properties, provided you’re not a real estate professional. Although passive income streams like rental real estate, stock dividends, or online courses may require time, effort, or money to establish, they eventually become more hands-off, with only periodic check-ins needed, such as administrative tasks or tax management.

Experts like Marguerita Cheng see growing opportunities for passive income, highlighting avenues like affiliate marketing and e-books, making it an attractive option for those looking to supplement their primary income or build wealth for retirement. It also provides financial security during periods of inflation, unemployment, or voluntary breaks from work.

Though the work may be front-loaded, passive income continues to offer cash flow over time, allowing individuals to earn money without consistent, active engagement, making it a valuable addition to any financial strategy.

The Origin of the Concept

The modern idea of passive income gained widespread attention through Robert Kiyosaki’s influential book Rich Dad Poor Dad. First published in the late 1990s, Kiyosaki introduced the notion of making money work for you, a core principle of financial independence. Kiyosaki’s philosophy emphasized that earning through passive income streams could lead to financial freedom and long-term wealth, allowing individuals to break free from the traditional paycheck cycle.

Although Kiyosaki popularized the term, the idea of earning without directly working for it each day has been around for centuries. The concept aligns with older financial practices, where investments or properties provide ongoing revenue streams without the need for continuous labor.

History of Passive Income

The foundation of passive income lies in ancient economic practices such as land ownership and intellectual property. Landlords in medieval times earned rent from tenants who cultivated their lands, giving the owners a steady source of income without any active farming. Similarly, artists, writers, and inventors earned royalties from their intellectual property, creating a stream of income that required minimal ongoing effort. Today, modern entrepreneurs might explore options like term loans to support their investments in passive income streams.

The concept of royalties from books, music, and patents has deep roots in history. Creative individuals were able to license their work, allowing others to use it in exchange for a payment, often based on sales or usage. This created a passive stream that would last as long as the work continued to hold value in the market. The historical precedent for passive income laid the groundwork for modern approaches to financial independence.

How Passive Income Works

Passive income is primarily generated from assets that continue to produce value or revenue over time. These assets can be physical, such as real estate, or intellectual, like books or patents. The key factor is that after the initial setup, the effort required to maintain these assets is minimal. Whether you’re interested in generating income from business credit cards or other financial tools, there are numerous ways to create passive income streams.

Examples of Passive Income Streams

Rental Properties

One of the most common and historically proven ways to generate passive income. After purchasing or developing a property, renting it out provides a steady monthly income. The key work is in maintaining the property and managing tenants, but this is often outsourced to property management companies. For more insights on financing your real estate ventures, check out Investment Funds or Term Loans.

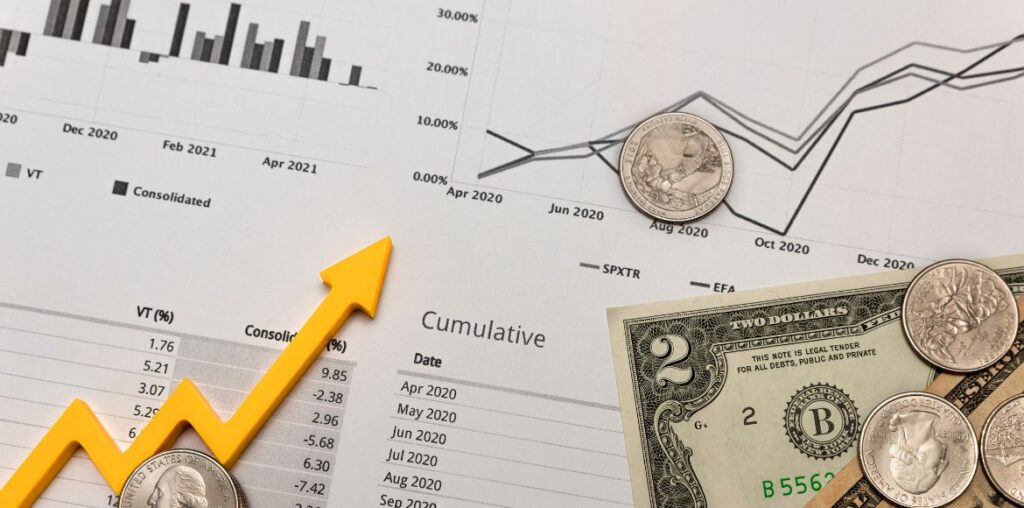

Dividends from Stocks

Dividends are payments made to shareholders from a company’s profits. Investing in dividend-paying stocks can generate a regular income stream as companies distribute part of their earnings to shareholders. Once the stocks are purchased, the investor can earn income passively while holding their shares.

Royalties from Intellectual Property

Authors, musicians, and inventors can earn royalties by licensing their creative works or patented inventions. Every time a book is sold, a song is streamed, or a patented item is used, the creator earns a percentage of the revenue.

These examples illustrate that while some upfront investment is required, the ongoing effort to maintain the income stream is minimal.

Online Courses

Educators and experts can create and sell online courses on platforms like Udemy or Teachable. After the initial course is developed, it can be sold to students without further involvement. You can explore more about building passive income through online courses in our article Building Passive Income: Your Comprehensive Guide to Financial Freedom.

Key Characteristics of Passive Income

To fully understand how passive income works, it’s important to recognize its key characteristics:

Minimal Active Participation After Setup

Once the system or asset is in place, passive income requires little day-to-day involvement. Whether it’s property management or stock investments, the ongoing effort is limited.

Upfront Investment

Most passive income streams require an initial input of either time or money. This could mean the purchase of property, writing a book, creating a course, or investing in stocks. The upfront work is significant, but once established, the system largely runs on its own.

These characteristics make passive income appealing to those seeking financial independence and long-term wealth. Additionally, those seeking to improve their financial habits can benefit from understanding how to improve their credit score.

Why Passive Income is Valuable

The value of passive income lies in its ability to provide financial security without the constant trade of time for money. This form of income allows for freedom and flexibility that traditional 9-to-5 jobs don’t offer. Here are some of the key reasons why passive income is valuable:

- Financial Stability: Having a steady income stream that doesn’t rely on daily work helps create a safety net. This added security can provide peace of mind, especially in uncertain economic times.

- Freedom to Pursue Other Ventures: Because passive income doesn’t demand constant attention, it frees up time to explore other business opportunities or personal interests. This flexibility can help individuals achieve a better work-life balance.

- Long-Term Wealth Creation: Passive income is essential for building wealth over time. As these income streams continue to generate revenue, individuals can reinvest in other assets or use the income to cover living expenses, allowing their wealth to grow.

For anyone seeking to better manage their cash flow and increase financial security, learning cash flow tips is a crucial step toward making the most of passive income streams.

Common Misconceptions about Passive Income

While passive income is often seen as the “holy grail” of financial freedom, there are a few misconceptions that need to be addressed:

- It Requires Zero Effort: Many people believe that passive income streams operate entirely on their own. While it’s true that passive income doesn’t require constant work, there is usually significant upfront effort involved. Whether it’s researching investments, developing a product, or setting up a rental property, the initial work can be demanding.

- It’s a Quick Way to Get Rich: Another common misconception is that passive income leads to fast wealth. In reality, most passive income streams take time to grow and become substantial. For example, real estate or stock dividends typically require years of accumulation before they can generate significant income.

Understanding the common misconceptions about passive income can help manage expectations and guide individuals toward more realistic financial goals.

Difference Between Passive Income and Active Income

The main difference between passive and active income is the amount of effort required to generate it. Active income, such as wages or salary, is directly tied to the time and effort put into the work. You must continually perform tasks to keep earning, and once you stop working, the income stops.

In contrast, passive income continues to flow once the system is set up, even with little day-to-day involvement. For example, choosing whether to take on personal debt or company debt can be part of a larger strategy to create passive income and long-term financial security.

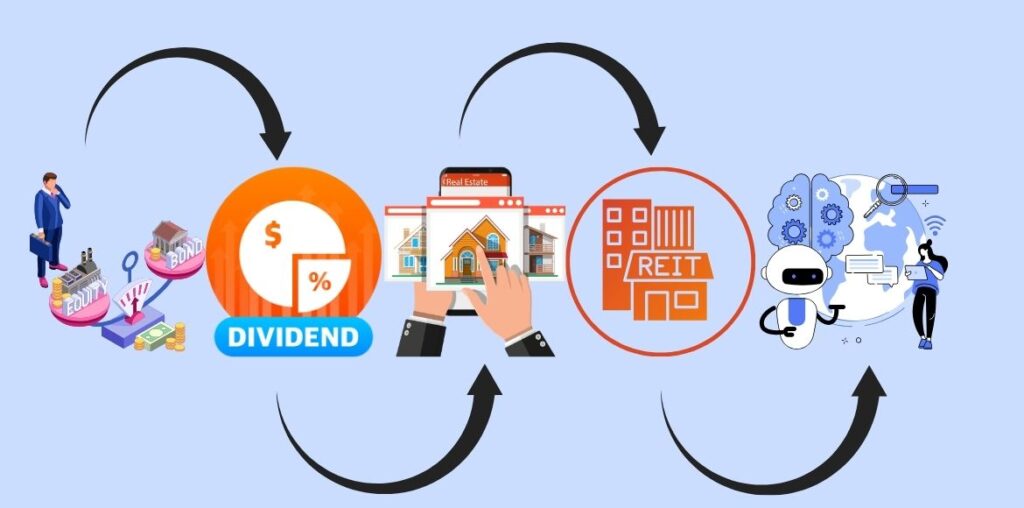

Popular Passive Income Streams

Several passive income streams have proven effective over time, each with its own set of benefits:

- Real Estate: One of the most established methods of generating passive income. Purchasing properties and renting them out can lead to steady cash flow.

- Stock Dividends: By investing in dividend-paying stocks, investors can earn regular payments without needing to sell the underlying asset.

- Royalties from Intellectual Property: Creative works, whether books, music, or inventions, can generate royalties long after their initial creation, providing a steady stream of income.

- Affiliate Marketing: With the rise of online platforms, affiliate marketing has become a popular method of generating passive income. By promoting products and earning commissions, individuals can generate income from referrals without directly selling products.

The Modern Evolution of Passive Income

With the growth of the digital economy, the opportunities for earning passive income have expanded dramatically. The internet has opened doors to new avenues, including:

- E-commerce: Platforms like Shopify and Amazon allow individuals to set up online stores and sell products without needing to be involved in every transaction.

- Content Creation: YouTube, blogs, and podcasts offer creators a way to earn through advertising, sponsorships, and affiliate marketing. Once content is posted, it can continue to generate revenue indefinitely.

- Online Courses: Educators and experts can create and sell online courses on platforms like Udemy or Teachable. After the initial course is developed, it can be sold to students without further involvement.

This shift in the digital landscape has dramatically expanded the potential for earning passive income in today’s economy.

In conclusion, passive income offers a powerful way to achieve financial freedom and long-term wealth. Though it often requires upfront effort, the benefits of having income streams that require minimal ongoing work make it a valuable financial strategy. By understanding the nature of passive income and the modern options available, individuals can take steps toward financial independence and security.

Frequently Asked Questions (FAQs)

What is passive income?

Passive income refers to earnings that require minimal ongoing effort to maintain. It often comes from assets or investments, such as rental properties, stock dividends, or royalties from intellectual property, which generate revenue without the need for daily work.

How does passive income differ from active income?

Active income requires direct, continuous effort to earn, such as wages or a salary from a job. In contrast, passive income continues to generate money after the initial setup, requiring much less time and effort once it’s established.

What are common types of passive income streams?

Popular passive income streams include rental properties, dividends from stocks, royalties from creative works like books or music, affiliate marketing, and online businesses or courses.

Is passive income truly effortless?

No, passive income often requires significant upfront work, such as researching, setting up systems, or investing capital. However, once these systems are in place, they typically require much less day-to-day involvement compared to active income.

How long does it take to establish a passive income stream?

The time it takes to establish a passive income stream varies. It could take months or even years, depending on the type of income stream. For instance, building a successful rental property business or growing stock dividends can take significant time, while others, like affiliate marketing, may take less time but require ongoing content creation.

Leave a Reply