[fusion_dropcap color="#000000" class="fusion-content-tb-dropcap"]I[/fusion_dropcap]n today’s fast-paced world, achieving financial security can be challenging. Many people work long hours but still struggle to meet their financial goals. This is why more individuals are turning to passive income strategies to create additional revenue streams without sacrificing their time and energy. This is where the concept of passive income comes into play.

Approximately 20% of Americans receive some form of passive income each year. This income primarily comes from sources such as interest on savings and bonds, dividends from stocks, and non-professional rental agreements (like renting a room to a roommate). In this article, we will explore what passive income is, the various sources available, and how you can start generating it to pave the way toward financial freedom.

What is Passive Income?

In a world where financial stability and independence are increasingly valued, passive income has emerged as a buzzword that captures the interest of investors, entrepreneurs, and individuals seeking to secure their financial future. But what exactly is passive income, and why is it so appealing? This article explores the concept of passive income, its various forms, the taxation frameworks in different countries, and practical strategies to generate passive income streams. For a more detailed guide, you can refer to this comprehensive guide to financial freedom.

Defining Passive Income

Passive income consists of earnings received without the necessity of actively engaging in work-related tasks. This type of income can arise from various sources, including investments, dividends, rental income from real estate, business ownership, online ventures, educational courses, downloadable products, established YouTube channels, website advertising, affiliate marketing, and more.

Active Income vs. Passive Income

Active income refers to the earnings generated through direct work efforts. This encompasses various forms of compensation such as wages, salaries, tips, commissions, freelance work, side jobs, and other income derived from employment. Essentially, individuals are exchanging their time and effort for financial compensation.

| Term | Description |

|---|---|

| Passive Income | A type of unearned income acquired with minimal labor to earn or maintain. |

| Definition | Income that requires little to no labor to produce and maintain. |

| Examples | Rental income and business activities where the earner does not materially participate. |

| Financial Independence | Passive income can be a way to create financial independence and early retirement. |

| Taxation | Passive income, as an acquired income, is taxable. |

| Passive vs. Active Income | The degree of passivity of an income depends on the perspective of the person; what is seen as passive income by one may be active income to another. |

The Importance of Passive Income

Financial Security

Passive income plays a crucial role in achieving financial security. It provides an additional layer of income that can help individuals weather economic downturns or unexpected expenses. By diversifying income sources, individuals reduce their dependence on a single paycheck, creating a buffer against financial uncertainties.

Wealth Accumulation

The ability to generate passive income can significantly contribute to wealth accumulation. Reinvesting passive income can lead to compound growth, allowing individuals to build substantial wealth over time. This is particularly evident in investments like real estate and dividend stocks, where the potential for appreciation is high. Check out these investment fund options for more information.

Time Freedom

One of the most compelling reasons to pursue passive income is the promise of time freedom. Individuals can leverage their investments to create income streams that allow them to spend more time with family, pursue hobbies, or engage in philanthropic efforts.

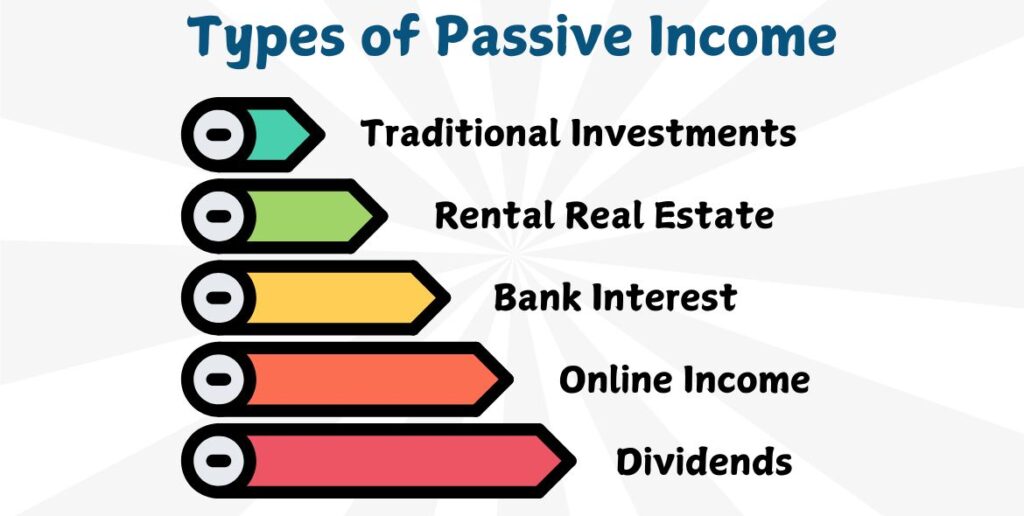

Types of Passive Income Streams

Understanding the various types of passive income can help individuals identify which streams align with their financial goals:

Traditional Investments

Investing in the stock market allows your money to generate income through interest, dividends, and capital gains. This process is entirely passive, requiring nothing more than your initial investment. You can start small with dividend stocks.

Bank Interest

By placing your money in a savings account, you can earn passive income through interest. Opting for a high-yield savings account can enhance your earnings without any additional effort on your part, making it a truly passive income source.

Dividends

Dividends can come from stocks, bonds, or even businesses you own, providing a stream of income without the need for active work. Typically, these payments are distributed on a quarterly or monthly basis.

Rental Real Estate

Owning rental properties is one of the most effective ways to generate passive income. While initial investments of time and money are necessary to secure and manage the property, once rented out and potentially managed by a third party, it can lead to nearly hands-off income.

Online Income

Establishing an online business can be time-intensive, but once you have a system in place for generating leads and sales, much of the process can be automated. Additionally, employing an operations and leadership team allows you to simply receive income without being actively involved in day-to-day operations.

The Benefits of Passive Income for Financial Freedom

Financial Freedom

Passive income creates additional streams of income that don’t require constant effort or active participation. This financial freedom allows you to alleviate stress and focus on other priorities, such as personal interests, hobbies, or spending quality time with family.

Wealth Building

By diversifying your income sources, passive income can help you accumulate savings and investments over time. This approach leads to increased financial security and stability, making it easier to navigate today’s unpredictable economic environment.

Safety Net During Difficult Times

Passive income serves as a safety net if you lose your primary source of income. Having these streams can help cover your expenses until you secure another job or source of income, providing much-needed relief during challenging periods.

Accelerated Achievement of Financial Goals

With extra income from passive sources, you can achieve financial goals more quickly, whether it’s saving for retirement, purchasing a home, or funding a child’s education. This reduces reliance on loans or debt, allowing for more manageable financial planning.

Tax Advantages

Many passive income sources come with tax benefits, such as deductions for property depreciation in real estate or favorable tax treatment on long-term capital gains from investments. These advantages can enhance your overall earnings and improve your financial strategy.

Flexible Lifestyle

Passive income allows you to earn money without actively working, giving you the freedom to design your life according to your preferences. This flexibility can lead to a better work-life balance, enabling you to pursue your passions, travel, or engage in leisure activities.

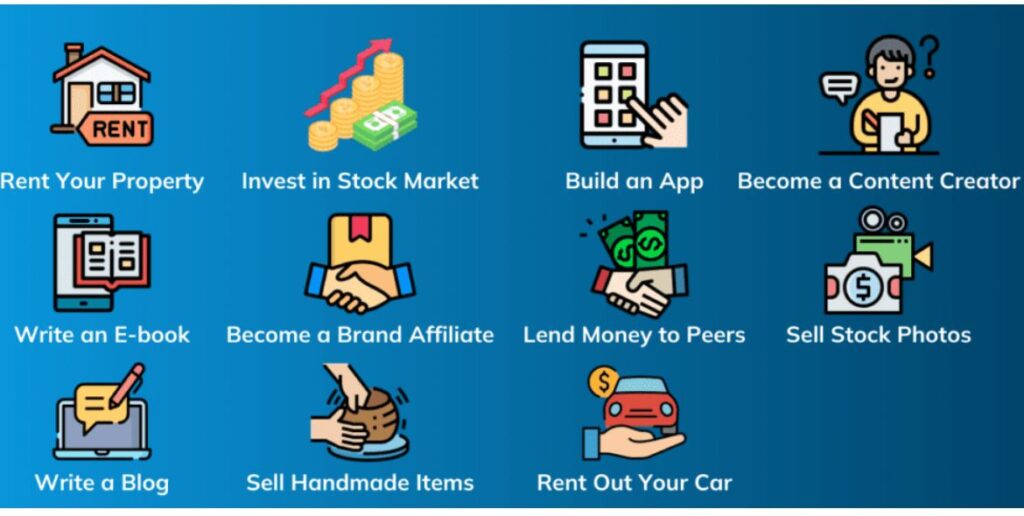

Passive income ideas for beginners

If you’re looking to start generating passive income, there are several beginner-friendly ideas you can explore. One of the simplest ways is to open a high-yield savings account, where your money can earn interest with minimal effort. Although the returns may not be substantial, it’s a straightforward method to start accumulating passive income. Another option is to invest in dividend stocks. By purchasing shares in companies that pay dividends, you can receive regular payments, providing a steady stream of income. Here are some passive income ideas for beginners to get you started.

How to Start Building Passive Income: Tips for Beginners

Start Small, Think Long-Term

Passive income takes time to grow, so begin with small investments or manageable projects. Whether it’s creating an online business, investing in stocks, or renting real estate, start small and gradually increase your investments as you learn and gain confidence.

Research Thoroughly

Not all passive income ideas are created equal. Some require more upfront work or capital. Research different opportunities like dividend stocks, real estate, or digital products to find what aligns with your skills and interests.

Diversify Income Streams

Relying on one source of passive income can be risky. Consider diversifying by having multiple income streams, such as a mix of real estate, stock investments, and digital content like online courses or blogs.

Focus on Automation

Automation is key to passive income. Whether it’s automating your investments, setting up automated affiliate marketing, or hiring property management for rental properties, look for ways to reduce hands-on involvement.

Be Patient and Persistent

Passive income takes time to build. It may not yield immediate returns, so patience and persistence are crucial. Keep nurturing your passive income streams and reinvest to expand your earnings.

Stay Informed on Taxes

Passive income is taxable, so be sure to understand the tax implications of your investments or earnings. It’s a good idea to consult a tax professional to ensure you’re managing it properly.

Common Myths About Passive Income

| Common Myths | Reality |

|---|---|

| Passive Income Requires No Effort | Setting up passive income streams usually requires significant upfront work, such as creating a blog or acquiring rental properties. |

| You Need a Lot of Money to Start | While some avenues like real estate need capital, options such as affiliate marketing or digital products can be started with minimal upfront costs. |

| All Passive Income is Truly Passive | Most passive income streams need periodic attention, such as property maintenance or monitoring investment portfolios. |

| Passive Income Provides Immediate Results | It often takes time to see results from passive income sources. Growth is usually slow but steady. |

| Passive Income Is Always Tax-Free | Passive income is usually taxable, and it’s important to understand the tax implications for rental income, dividends, and digital earnings. |

| You Can Quit Your Job Once You Have Passive Income | Passive income may not fully replace your main income right away. It takes time to grow income streams enough to become financially independent. |

| Only Wealthy People Can Generate Passive Income | Anyone can start with the right strategy, beginning small with stocks, digital products, or low-cost ventures. |

| Passive Income is Risk-Free | Passive income comes with risks, such as stock market volatility or real estate vacancies, making diversification important to minimize risks. |

Passive income represents a powerful avenue for achieving financial independence and stability. In a world where traditional employment may not suffice to meet financial goals, understanding and leveraging passive income can provide individuals with the opportunity to generate income with minimal effort. From investments in stocks and real estate to online ventures and affiliate marketing, the possibilities for creating passive income are diverse and accessible.

By embracing the principles of passive income, individuals can not only enhance their financial security but also enjoy greater freedom and flexibility in their lives. The key to success lies in starting small, conducting thorough research, and being patient throughout the journey. As you explore various passive income streams, remember to diversify your sources and stay informed about the tax implications. With the right approach and mindset, you can set yourself on a path toward a more financially secure future, allowing you to focus on what truly matters in life. Whether your goal is to retire early, travel more, or simply enjoy a more comfortable lifestyle, passive income can help you achieve your dreams while minimizing the time and effort required. Ready to start building your passive income? Check out our guide on the best ways to create passive income.

Frequently Asked Questions (FAQs)

What is passive income?

Passive income is money earned with minimal effort required to maintain it. It typically comes from sources such as investments, rental properties, dividends, or businesses where the owner does not actively participate in daily operations.

How does passive income differ from active income?

Active income involves earnings generated from direct work efforts, such as wages, salaries, or freelance work, where individuals trade their time for money. In contrast, passive income requires little to no ongoing effort once the initial investment or setup is complete.

Can anyone start earning passive income?

Yes, anyone can start earning passive income with the right approach and strategy. Beginners can explore simple options such as high-yield savings accounts, dividend stocks, or creating digital products that require minimal ongoing maintenance.

Is passive income taxable?

Yes, passive income is taxable. The tax implications vary depending on the source of income, so it’s essential to understand the relevant tax laws and consult with a tax professional if needed.

What are some beginner-friendly passive income ideas?

Beginner-friendly passive income ideas include opening a high-yield savings account, investing in dividend stocks, renting out a room or property, creating an online course, or generating income through affiliate marketing on a blog or website.

Leave a Reply